Black Entrepreneurs – 2021 Trends

Black Entrepreneurs – 2021 Trends

Black Entrepreneurs 2021

Each year, Guidant Financial and the Small Business Trends Alliance (SBTA) surveys business owners to learn about small business trends and life as a small business owner. A founding member of the SBTA, Guidant Financial is proud to be part of this group of companies dedicated to supporting small business in America with data trends and insights. The SBTA reports on data to help small business owners grow their businesses as well as bring transparency to small business ownership by giving prospective business owners the information they need to be successful.

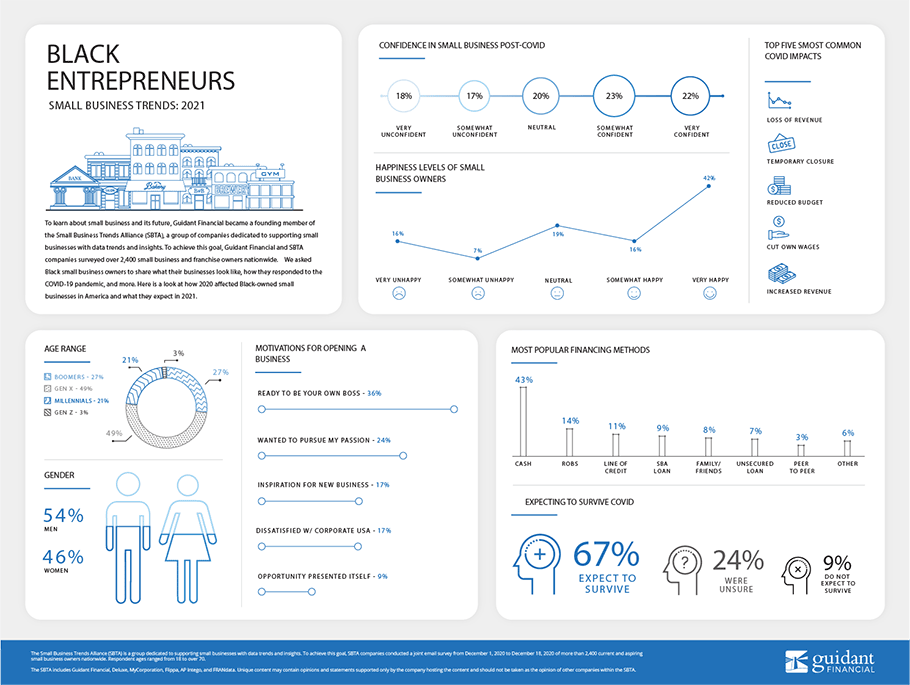

This year, Guidant and the SBTA surveyed over 2,400 current and aspiring small business owners nationwide with our annual Small Business Trends survey. We asked Black small business owners questions ranging from their experiences throughout the COVID-19 pandemic to their confidence in business given the current political landscape to their biggest obstacles as business owners.

Here’s a look at current Black-owned small business trends and what to expect in the coming year.

Who are Black Small Business Owners in America?

The largest subset of People of Color (POC) small business owners in America, Black entrepreneurs are an essential part of our small business economy.

With women making up 46 percent of Black entrepreneurs, this group shows one of the highest percentages of female small business owners in any segment – 53 percent higher than white small business owners. The plurality (33 percent) of surveyed Black small business owners had Bachelor’s degrees. The next most common level of education was Master’s degrees, at 26 percent.

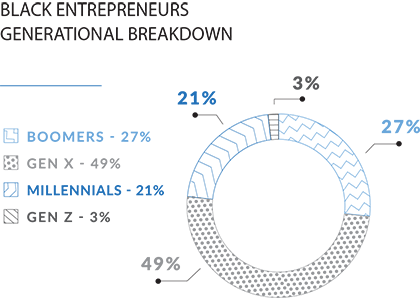

Black small business owners skew younger than their white peers. Twenty-seven percent of Black entrepreneurs are boomers, compared to 46 percent, 49 percent are Gen X compared to 43 percent, 21 percent are Millennials compared to 11 percent, and three percent are Gen Z, compared to less than one percent of white small business owners.

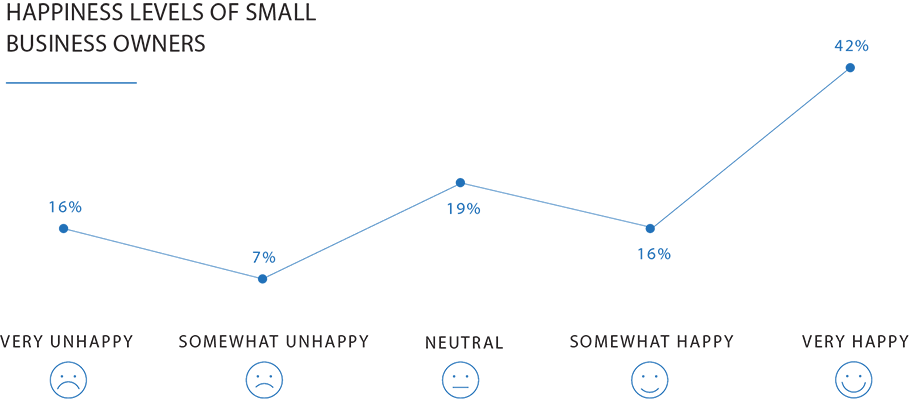

The majority (36 percent) of Black small business owners decided to go into business for themselves because they were ready to become their own boss. Twenty-four percent wanted to pursue their passion, 17 percent were inspired with a new business idea, and 17 percent were dissatisfied with corporate America. The plurality (42 percent) of Black entrepreneurs are very happy as small business owners.

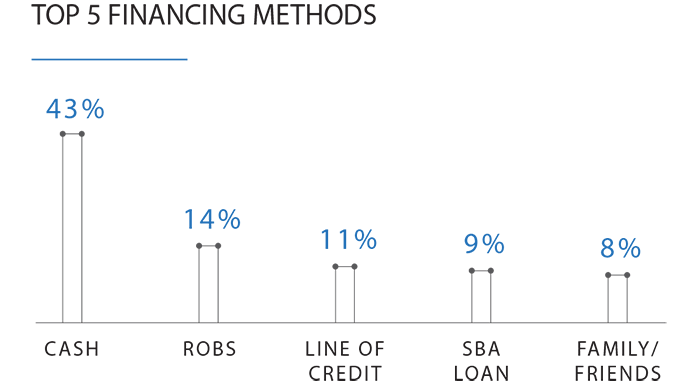

Cash is the most popular small business funding option for Black small businesses; 43 percent of Black entrepreneurs used cash alone or combined cash with another financing method to start their small business. The majority (59 percent) of surveyed Black-owned small businesses required $50,000 or less to start up. The vast majority of Black entrepreneurs started their own new independent business as opposed to starting or buying a franchise location or buying an existing small business, at 77 percent.

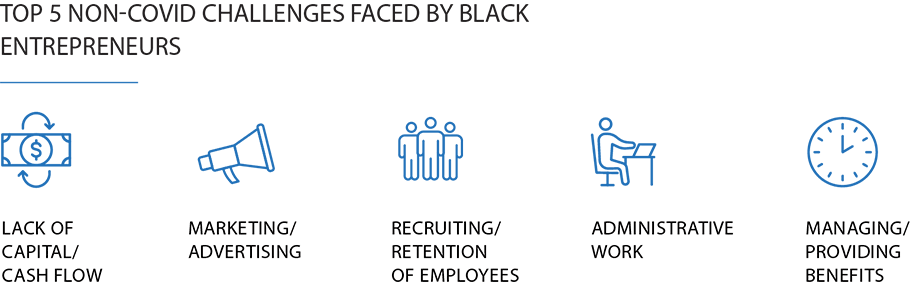

With only 54 percent of surveyed Black-owned small businesses being profitable in 2020, it comes as little to no surprise that the biggest struggle among this segment over the last 12 months has been a lack of capital or cash flow, at 38 percent of the share of responses.

COVID-19, Politics, and the Black Small Business Community

The COVID pandemic has affected Black small business even more than many others, due to Black businesses being concentrated in hard-hit service industries, as well as the struggles Black businesses have with equitably receiving funding and financial aid. The Small Business Trends survey saw these challenges reflected in the difference between survival expectations between the average of small business owners and Black small business owners: 17 percent fewer Black business owners expect their businesses won’t survive the pandemic than the average of small business owners. Most surveyed white small business owners (81 percent) expect their business to survive COVID, compared to only 67 percent of Black small business owners.

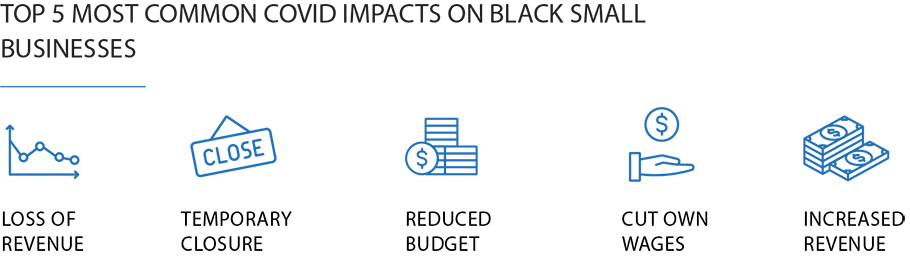

About 24 percent of surveyed Black-owned small businesses lost revenue due to the COVID-19 pandemic in 2020. Twelve percent closed temporarily. With their businesses hit harder than white businesses, it’s illustrated that Black small business owners are more concerned about COVID – when asked how important COVID-19 was to them as a current topic, 82 percent of Black small business owners said it was “very important” on a five-point scale from “not important at all” to “very important. Only 57 percent of white small business owners said COVID-19 was “very important” to them.

A higher percent of Black small business owners also called economic relief “very important” to them as opposed to their white peers: 73 percent to 43 percent. Fifty-three percent of surveyed Black respondents did not receive financial aid via the Paycheck Protection Program (PPP) or Economic Injury Disaster Loan (EIDL).* Thirty percent more surveyed white business owners received PPP or EIDL aid than Black small business owners.

*Note: The Small Business Trends survey was performed before the new stimulus act was passed into law and active as of January 01, 2021.

On a five-point scale of “strongly disliked” to “strongly liked” the US government’s response to the COVID pandemic, 41 percent of Black small business owners answered they “strongly disliked” the response. Only 28 percent of white small business owners responded with “strongly disliked.” On average, Black small business owners are neutral about their level of confidence in small business given the political climate though they lean neutral to positive about the future of small business, post-COVID.

Tellingly, a powerful 41 percent of surveyed Black small business owners said they didn’t belong to or feel represented by any US political party, while only 25 percent of white small business owners had the same response. Forty percent of Black small business owners said they belonged to or felt represented by the Democratic party, while 13 percent answered Republican.

The Future of Black-owned Small Business

Despite these hardships, the majority of Black small business owners (55 percent) want to grow their business, as opposed to sustaining it, selling it, or opening a new location. Sixty-one percent of respondents said they have plans to expand or remodel their business in 2021, while 51 percent plan to invest in digital marketing, and 46 percent plan to hire more staff. It’s clear that COVID and political challenges haven’t diminished these entrepreneurs’ determination for growth and success.

While the disparity between Black- and white-owned small businesses is clear, part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act includes significant funds to help “minority-owned” businesses in specific. Additionally, President Biden’s economic “Build Back Better” plan includes making business aid more equitable across minority populations.

With more governmental assistance and a resilient, determined attitude for future success, Black-owned small businesses will sustain through 2021 and hopefully, begin to rebuild at the same time.

Additional Learning Resources

Ready to use your retirement funds to start your business?

Don’t have any more questions about ROBS? Great, let’s get the process started today!