10 Best Investments for 2024

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Trying to pick the one or two investments that will make you the most money right now can feel like a fool’s errand. After all, a predicted recession hasn’t happened, and it seems unlikely that it will. And while rates are expected to fall slightly this year, they haven’t budged so far.

Check Out: 4 Genius Things All Wealthy People Do With Their Money

Since no one can predict what scenario will play out over the next six months, it’s best to consider a variety of investments that collectively can provide you with income, safety and the potential for growth.

What Are the Best Investments for 2024?

If you’re on the lookout for investment opportunities, here’s a look at 10 of the best investments you can consider for your portfolio.

1. High-Yield Savings Accounts

A high-yield savings account pays higher-than-average interest rates, so your money grows faster than it would in a traditional savings account paying average rates. The account is fully liquid, meaning you can withdraw your money whenever you want. Although you can find high-yield savings accounts at brick-and-mortar banks like Capital One, online banks and credit unions typically pay the highest rates.

Why We Like Them

For more conservative investors, there’s rarely been a better time to keep your money in a high-yield savings account than now. High-yield savings yields skyrocketed amid the Federal Reserve’s aggressive rate hikes in 2022 and 2023. Whereas rates on even the best high-yield savings accounts were about 0.50% in 2020, now you can find accounts paying 5% or even more. That’s a pretty high yield for an insured savings account, considering that the average savings account rate is just 0.45% as of May 20, making it a good place to hide if you’re worried about more stock market sell-offs in 2024.

What To Watch Out For

Your money is safe in a high-yield savings account — there’s no chance of losing your principal up to the coverage limit or the interest it earns even if the bank fails. This is because your accounts are insured for up to $250,000, and some banks offer even more insurance than that.

However, savings accounts of all types carry inflationary risk, which is a loss of purchasing power due to inflation. The inflation rate is 3.4% as of May, so your account needs to yield at least that much to retain its purchasing power.

2. Series I Savings Bonds

Series I bonds are a type of savings bond that’s structured to eliminate the risk that inflation will rob the bond of spending power. The bonds are issued at face value with a 20-year original maturity period followed by a 10-year extended maturity period. They have a composite rate with two parts: a fixed rate, which stays the same for the entire term, and an inflation rate that changes as often as every six months relative to the inflation rate.

Why We Like Them

While I bond rates are down from the 9.62% composite rate that made headlines in 2022 — a composite made up of a 9.62% inflation rate and a 0% fixed rate — the rate is still a respectable 4.28% for bonds purchased in the six-month period spanning May 1 to Oct. 31. Granted, you could earn the same rate with a high-yield savings account or CD, but unlike those products, tax on Series I bond earnings can be deferred until after the 30-year final maturity or until the bonds are otherwise redeemed. Plus, they’re guaranteed to hold their value regardless of inflation rates.

What To Watch Out For

You can redeem a Series I bond as soon as one year after it’s issued, but you’ll forfeit interest earned during the most recent three months if you redeem it within the first five years. In addition, you might owe tax on your earnings.

3. Short-Term Corporate Bond Funds

A corporate bond is like an IOU. Companies issue them to generate cash they can use for a variety of purposes, such as expanding, investing in equipment, paying shareholder dividends or buying back shares of their stock. By purchasing bonds, investors essentially loan the company money in exchange for the company’s obligation to pay the investors interest on their principal and, in most cases, pay back the principal when the bond matures.

Bonds and the companies that issue them receive credit ratings based on their risk of defaulting on their obligations to bondholders. Investment-grade bonds have stronger credit ratings and are safer than non-investment-grade bonds. Whichever type you choose, investing in a bond fund is less risky than investing in individual bonds of the same type because funds have built-in diversity — a small number of companies in a fund might default, but it’s unlikely that all will.

Why We Like Them

A short-term bond fund may not offer a huge amount of upside, but protecting you from the potential downside of the stock market may end up being the winning move. Short-term bond funds provide a modest amount of income in exchange for the security of getting your money back at maturity.

What To Watch Out For

Bonds are generally low risk, but not as low risk as savings accounts and CDs. Like those products, bonds have inflationary risk that can erode their purchasing power. They also have interest rate risk — the risk that rates will increase while your money is tied up on the bond. And some bonds allow the company to call them back before the maturity date, which might cause you to miss out on the rate you expected to earn on your investment.

4. Nasdaq-100 Index Funds

One hundred of the largest nonfinancial companies on the Nasdaq Stock Market make up the Nasdaq-100 Index. A Nasdaq-100 fund tracks the index and attempts to replicate its returns.

Why We Like Them

Over the last 20 years, the companies that make up the Nasdaq-100 Index have outperformed the S&P 500 by a wide margin. The index has produced a cumulative annualized return of 18.85% over the last 10 years and has gained 8.72% so far this year.

The Nasdaq-100 Index is more volatile than the broader market, which accounts in part for its larger loss in 2022 than the Dow Jones Industrial Average or the S&P 500 index. But when the Nasdaq bounces, it typically comes back hard and fast.

What To Watch Out For

The Nasdaq composite index took the brunt of the bear market in 2022, dropping 33%. It regained those losses to reach record levels this year, but you’ll still need a high tolerance for risk to invest in a Nasdaq-100 Index fund.

5. S&P 500 Index Funds

The S&P 500 index includes the 500 leading U.S. stocks. It’s widely regarded as a barometer of the overall market because it covers all sectors of the stock market, about 80% of U.S. market capitalization and 50% of the global equity market, according to S&P Global.

Why We Like Them

The S&P 500 — like every other major market index — has never failed to come back from a bear market and make new all-time highs. Although past performance can’t predict future results, this is an enviable track record and makes an S&P 500 ETF investment a solid long-term bet.

What To Watch Out For

A small number of companies can have a disproportionately large influence on the index. As of June 2023, for example, the top 10 companies accounted for as much as 35% of the total index market cap, according to E-Trade. So although S&P 500 index funds are less risky than individual stocks and funds that focus on specific sectors of the market, they might be less diverse than you realize.

6. Value Stock Funds

Value stock funds hold shares in companies Fidelity calls “diamonds in the rough” — those with stock prices that don’t reflect the companies’ fundamental worth. The thinking is that prices will appreciate as investors discover the companies’ value. As a bonus, many value stocks tend to pay relatively high dividends.

Why We Like Them

Value stocks tend to outperform during economic recoveries, according to an analysis by Vanguard. If the U.S. avoids a recession, which seems likely, the economy’s next move could be an acceleration that could bolster value shares.

What To Watch Out For

It’s too early to know whether the Fed has pulled off the “soft landing” that would support stronger performance for value stocks.

7. Dividend Stock Funds

Dividend stocks — many of which also happen to be value stocks — return a portion of earnings to shareholders. The benefit of holding these stocks is that you earn income (dividends) whether or not the share price appreciates. Dividend Aristocrats are companies that have increased their dividends for at least 25 years in a row.

Why We Like Them

In times of economic uncertainty, companies that pay high dividends tend to hold up better. To consistently pay a high dividend, a company needs a consistent revenue stream, and these are the types of businesses that investors value when the economy slows. Owning a fund of dividend stocks — especially Dividend Aristocrat stocks — is a good way to diversify your holdings, earn a solid income and protect yourself from the more volatile areas of the stock market.

What To Watch Out For

Focusing too much on dividend yields can be counterproductive. Look at the fund’s total returns as well as its suitability for your investing goals and risk tolerance.

8. Diversified Growth Stock Funds

Growth stocks appreciate faster than the average stock, so they can earn you high investment returns. The companies behind them tend to be newer, innovative companies, such as Netflix and Nvidia.

Why We Like Them

If you can stick with a diversified stock fund that owns high-quality growth names, that investment is likely to overcome rough patches and bounce back over time. Diversifying via a mutual fund or ETF is a good way to lower your risk instead of betting everything on a single stock.

What To Watch Out For

Growth stock prices are relatively expensive, so they can fall hard when they don’t produce the gains investors expect.

9. Real Estate Investment Trusts

Real estate investment trusts use investor funds to buy various types of property, managed by professionals, with the income passing through to shareholders. The law requires REITs to distribute at least 90% of the income generated by their investments back to investors.

Why We Like Them

REITs provide real estate investment opportunities that don’t require you to either manage it yourself or put up a massive down payment. Publicly traded REITs are relatively easy to trade on public exchanges, so they’re considered to be highly liquid. What’s more, dividends are typically high and volatility is often less than the stock market overall, giving you a bit of a hedge if there’s another tough market year ahead.

What To Watch Out For

SEC-registered nontraded REITs — those not traded on public stock exchanges — and private REITs are riskier, less liquid and can have higher fees than publicly traded REITs. Be especially cautious with private REITs, which are not regulated by the Securities and Exchange Commission.

10. Momentum Stocks and ETFs

Momentum investors look for stocks and exchange-traded funds that are on upward trends over the past days or weeks, or even the last few months — and are likely to keep going up. One way to identify them is by looking at the percentage of stocks and ETFs trading within 10% of their 52-week high to find the best-performing ones, according to Fidelity. Then find the ones that have had steep gains in the last one to four weeks.

Why We Like Them

According to Fidelity, there’s plenty of evidence to support the theory that markets making new highs will make even higher highs. You’ll have to watch the market carefully for signs that your shares are about to fall, but with any luck, your gains will have been large enough to give you some wiggle room.

What To Watch Out For

Momentum investing involves trying to time the market, which is risky under the best circumstances and especially risky when the market is volatile. Having an exit strategy, such as a stop loss, can reduce the risk of major losses.

The Best Investing Strategies To Use Right Now

Knowing what to invest in is just one part of investing successfully. Knowing how to invest is important, too. That’s where investing strategies come into play.

Dollar-Cost Averaging

Dollar-cost averaging is a good strategy to help you make money. If you own stocks, many of them were likely down in 2022 and 2023, and adding regular amounts every month to your portfolio would have allowed you to lower the long-term average cost of what you own by buying more shares when prices were low. Consistently buying regular amounts can help protect you from any volatility in prices.

Buy-and-Hold Investing

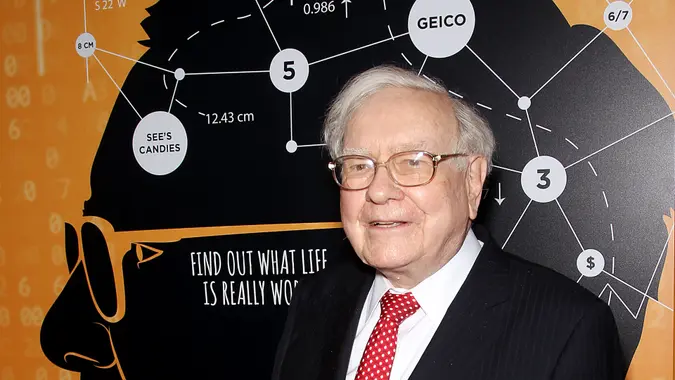

You could do worse than to implement Berkshire Hathaway CEO Warren Buffett’s favorite strategy of buying stocks you intend to hold for the long term — and then holding them for the long term. While Buffett has unloaded shares not long after buying them, and he has changed weightings of long-held stocks over the years, Berkshire Hathaway’s portfolio is remarkably consistent.

Dividend Reinvestment

You’re probably familiar with the “miracle” of compound interest, where the interest you earn on your savings account balance results in exponential growth of your funds. Dividend reinvestment works the same way. If you don’t rely on your investment dividends to cover your living expenses, reinvesting them can significantly increase your returns over time.

Final Thoughts

The best investments for 2024 — and the best investing strategies — help you maximize your returns while managing risk, even in volatile markets. To give yourself the best chance for success, review your asset allocation to make sure your portfolio has a mix you’re comfortable with. If not, consider rebalancing your portfolio by selling assets you have too much of and replacing them with assets that will get your allocation back into sync.

Just be wary of fees, especially if you’re investing in funds. Every dollar you pay out in fees reduces your gains — and increases your losses — by the same amount.

FAQ

The number of investment options available can be overwhelming. Here's what people are asking to try to sort them out.- What investments have the highest returns?

- Stocks have provided the highest average annual returns over the long term — 10% per year, according to the Financial Industry Regulatory Authority.

- What is the best investment to invest your money in?

- That depends on many factors, including your financial situation, your investing goals and your tolerance for risk. An investor who can't afford to lose any of their investment, or who doesn't want to, might consider a high-yield savings account to be best. An investor with a high risk tolerance and money to spare might prefer growth stocks.

- Where should I invest $100 right now?

- If you don't yet have an emergency fund, you can use the $100 to start one in a high-yield savings account. Or consider an S&P 500 ETF for a riskier option with the potential for greater returns.

- How can I double my money without risk?

- If your employer offers a 401(k) and matches employee contributions, contributing up to the match limit will double your money. Put the money into a safe investment such as Treasury securities or a money market fund to all but eliminate risk.

John Csiszar contributed to the reporting for this article.

Information is accurate as of June 10, 2024.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- FDIC. 2024. "National Rates and Rate Caps."

- Bureau of Labor Statistics. 2024. "Consumer Price Index Summary."

- Financial Industry Regulatory Authority. "Risk."

- Investor.gov. "Real Estate Investment Trusts (REITs)."

- Vanguard. 2023. "Valuations, economy may favor value stocks."

- Morningstar. 2023. "Markets Brief: Value Stocks Have Suffered In 2023 but Are Showing Signs of Recovery."

- Fidelity. "Momentum trading strategies."

- Fidelity. "2 schools of investing: Growth vs. value."

Written by

Written by  Edited by

Edited by