There’s a deluge of new data and research to wade through in the mobile games business. Our regular data drop column breaks it all down into digestible chunks.

Read on for the numbers you need to know about minus the fluff.

This column is sponsored by Appcharge, the direct-to-consumer platform for scaling paying users.

Get in touch to start maximizing your game profits through direct relationships with your players.

Ubisoft’s mobile income plunges year-on-year

An alarming stat in Ubisoft’s Q3 FY24 results: mobile bookings plunged from 43% of its bookings overall in FY23 to just 5% in FY24.

Why? Last year’s financial results “included the recognition related to the Assassin’s Creed Jade licensing partnership last year”, which suggests Tencent paid a hefty chunk of change to use the AC licence for the forthcoming open-world adventure, which is set in China.

Ubisoft added that Rainbow 6 Mobile and The Division Resurgence are set to launch by the end of March 2025.

Overall, Ubisoft earned €626m ($674m) in Q3 24, a little above its guidance of €610m. “This quarter provided us with positive momentum and marks the beginning of our turnaround,” said CEO Yves Guillemot.

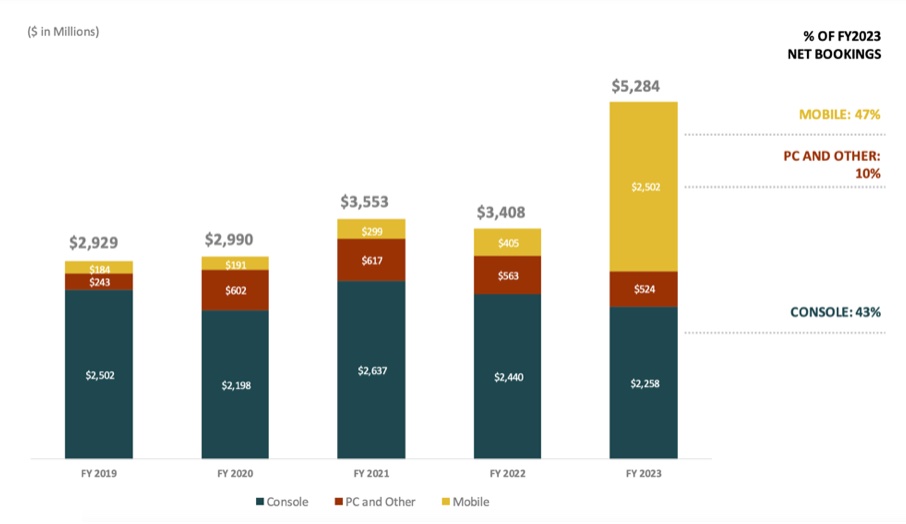

Mobile declines slightly at Take-Two/Zynga

Zynga owner Take-Two referenced some softness in the mobile ad market and increased UA spend for new Peak game Match Factory as it reported its Q3 FY24 results.

Mobile revenue for the quarter was down to $706.7m from $721.2m in FY23, and revenue fell YOY from $713.2m the prior year to $697.9m.

Zynga’s latest release Match Factory has “stellar retention and monetization metrics” on par with the likes of Too Blast, said Take-Two, which sees “strong long-term potential” for the match 3d game. It is now investing in “new features and a robust marketing campaign” for the title.

Fellow Peak game Toon Blast was also a highlight, which enjoyed its highest-ever DAU and “over 50% growth” in its daily IAP revenue compared to last quarter.

Ad revenues were below expectations overall, however, while Zynga’s direct-to-consumer business “continues to grow and enjoyed a record holiday season”. Game of Thrones: Legends and Star Wars Hunters will also launch this calendar year, the company said.

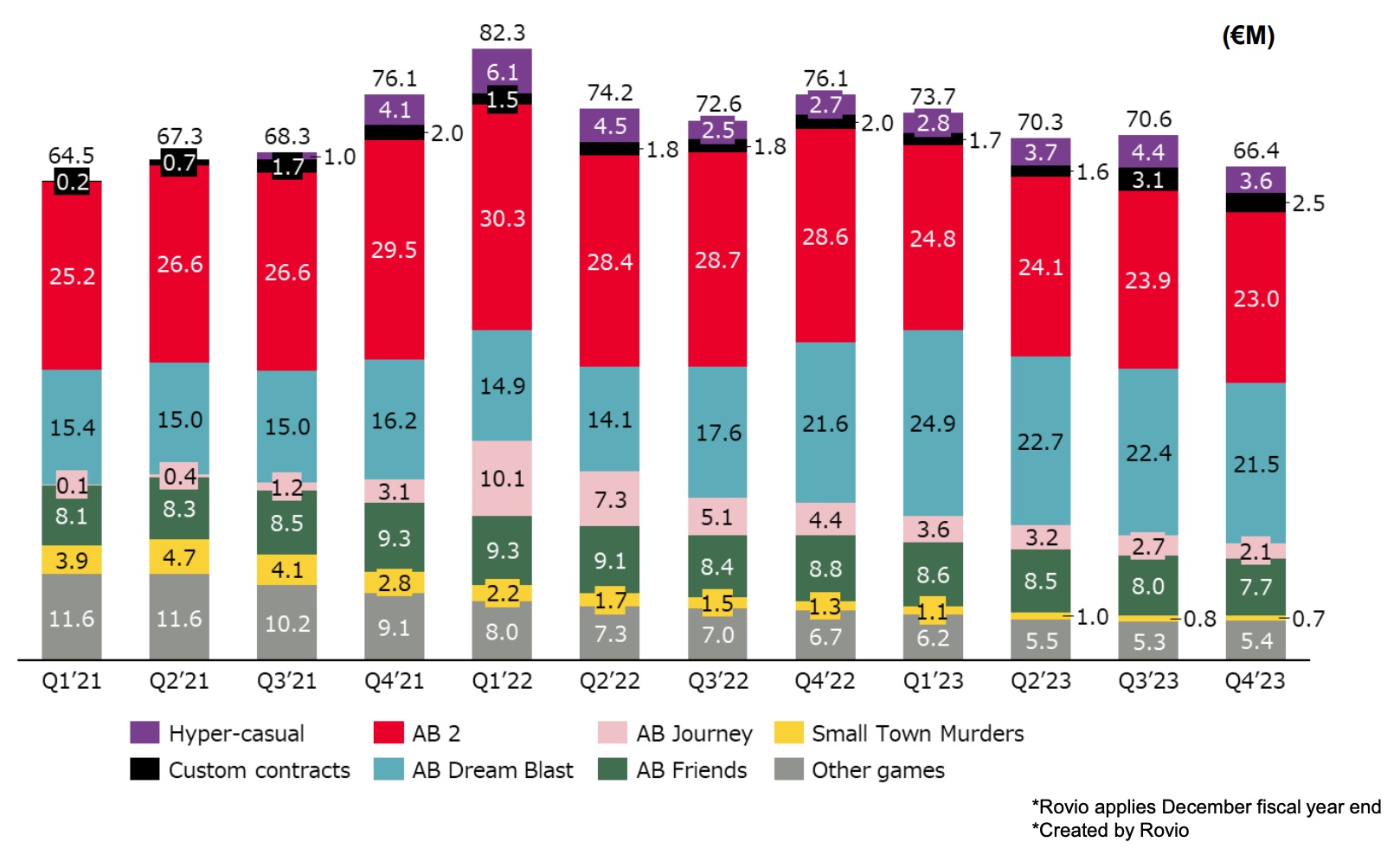

Rovio decline continues within new owner Sega

This helpful graph, tucked away within Sega’s latest financial results, gives us a good overview of what’s happening at Rovio:

Rovio sales for Q4 23 were down YOY to €66.4m (~$71.2m) after hitting €76.1m (~$81.6m) the year prior. Angry Birds 2 and Angry Birds Dream Blast remain the key titles for the Finnish firm.

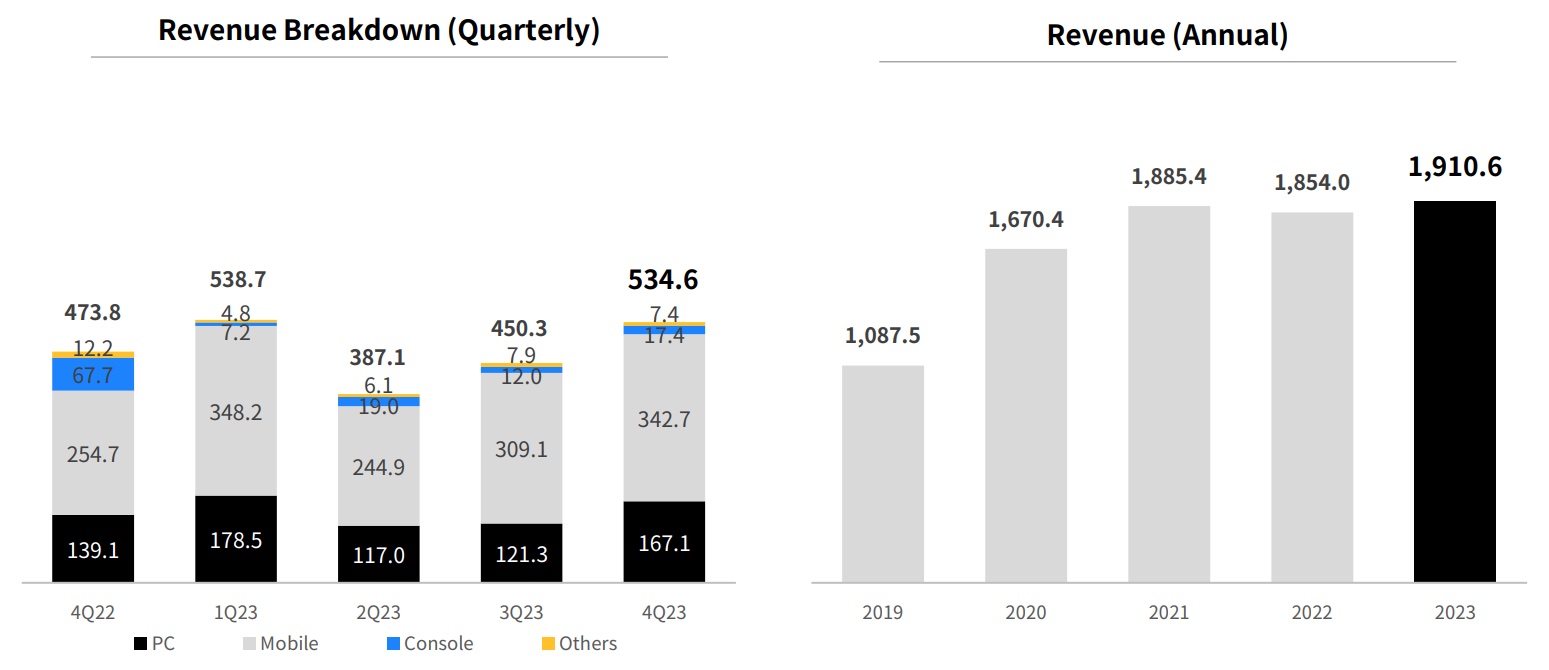

Mobile revenue up 34.5% at Krafton

The PUBG maker saw a healthy rise in mobile revenue as it reported its Q4 23 results. Q4 revenue was up 34.5% YOY, rising from KRW254.7bn (~$191m) to KRW342.7bn (~$257m)

Battlegrounds Mobile India was a big driver of that success after it returned to app stores in India.

The company also said that Dark and Darker Mobile and Animal Crossing-like game Dinkum Mobile were its priorities for 2024.

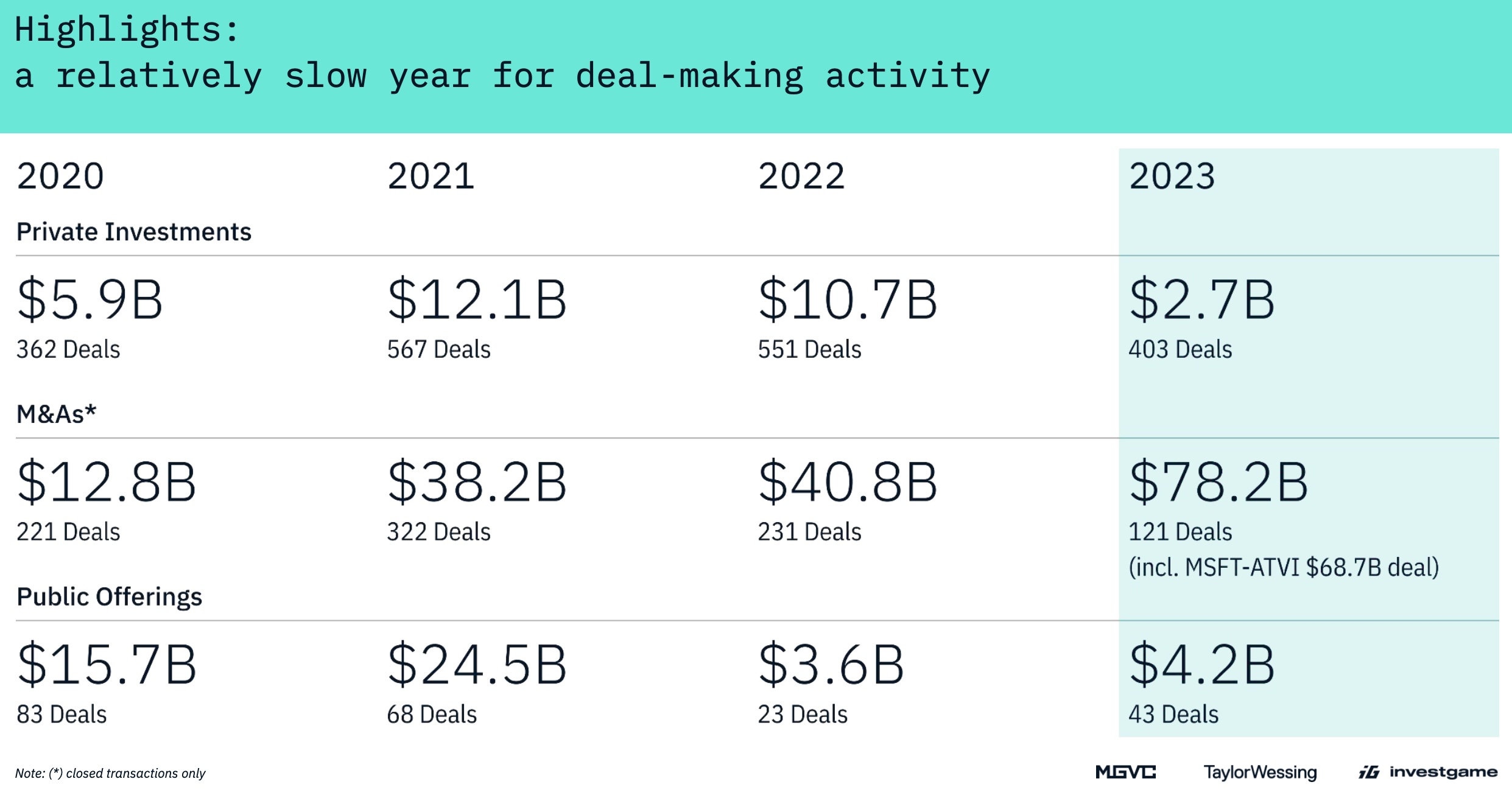

Dealmaking down in 2023, rebound forecast for 2024

InvestGame’s global gaming deals report depicts 2023 as a slow year for M&A, IPOs and private investments, though it expects the market to ‘pull out of its nosedive’ in 2024.

“This year, the industry may witness a rise in late-stage down rounds and shutdowns as numerous studios struggle to show solid performance in conduction with lofty valuations of previous rounds raised in 2020–22,” the report reads.

“At the same time, seed funding for newly opened studios is expected to maintain momentum, presenting investors with better entry terms.”

InvestGame also noted that VCs may make safer bets on game tech and ecosystem start-ups rather than studios and games in 2024 and beyond, because of gaming’s risky, hit-driven nature.

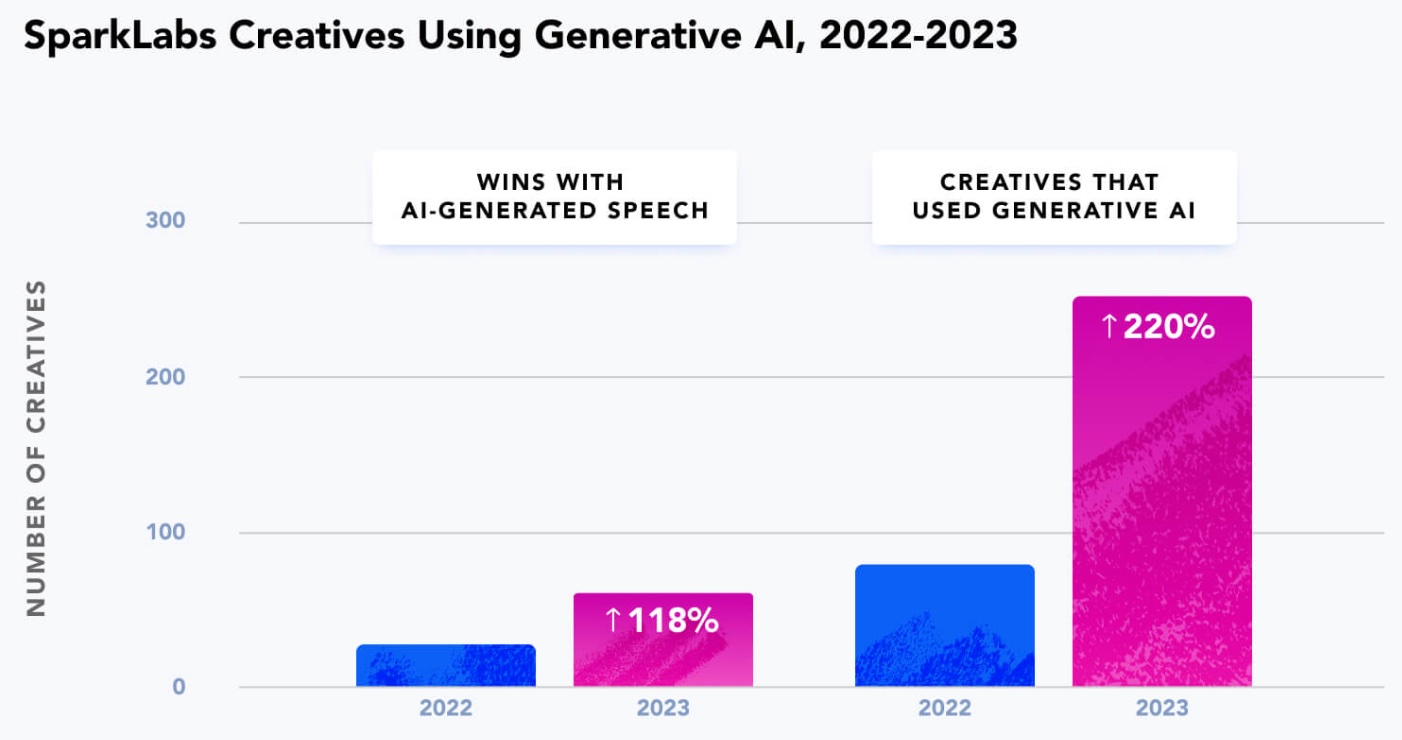

Generative AI and genre-bending on the rise in ad creative

A new AppLovin blog has some interesting numbers on how much AI is influencing ad creative.

Creatives that use generative AI are up 220% year-on-year, says this chart:

AppLovin also noted the divide between ad creative for hypercasual and midcore games blurring.

Hypercasual ad hooks – like runner or tycoon gameplay – are increasing in ads for midcore games, while hypercasual game ads are employing elements from the meta and live events.

Great Big Beautiful Tomorrow raises $3m to build ‘web3’s Among Us’

Former Disney and NBCUniversal gaming exec Chris Heatherly has raised $3m to make an Among Us-type game The Mystery Society, VentureBeat reports.

The studio, Great Big Beautiful Tomorrow, is building using blockchain tech and will launch the game in browser on Mac and PC initially, with iOS and Android to follow.