There’s a deluge of new data and research to wade through in the mobile games business. Our weekly data digest column breaks it all down into digestible chunks.

This column is sponsored by Appcharge, the direct-to-consumer platform for scaling paying users.

Get in touch to start maximizing your game profits through direct relationships with your players.

Monopoly Go hits $2bn, under $500m spent on UA

Scopely just announced that Monopoly Go has now passed $2bn in lifetime revenue since launch in April 2023.

In a blog from coCEO Javier Ferreira, the Scopely boss said that the game hit $2bn just three months after reaching $1bn in lifetime revenue.

There’s also a little nugget of info on Scopely’s UA spend, which Ferriera says is “less than a quarter of lifetime revenue to date” – which suggests a spend under $500m. The game has “marketing recoup rates that are still below 120 days” and “a level of profitability that is only seen in much more mature chart-topping games,” he added.

Elsewhere in the blog, Ferreira says the game has been downloaded over 150m times, and that it has over 10m daily players.

He also said that Monopoly Go players log in more than three times a day on average.

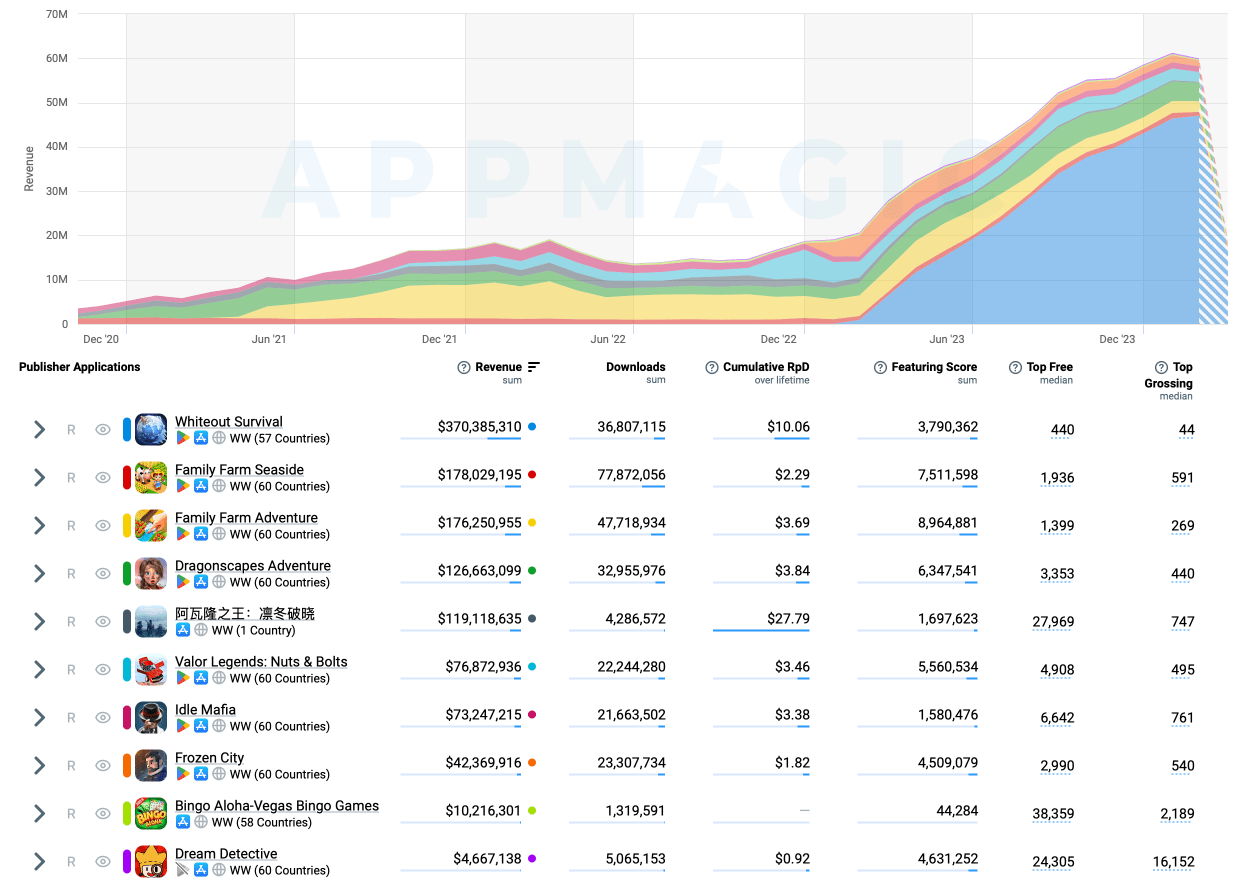

Whiteout Survival maker Century Games hits $2bn

Appmagic estimates that Century Games has passed $2bn in user spend in its latest blog. The top three games in its portfolio by revenue are Whiteout Survival (28% of the $2bn total), Family Farm Seaside (13%) and Family Farm Adventure (13%).

Elsewhere in the blog Appmagic notes that older title Frozen City is in decline, having peaked in March 2023 and hit around ~$40m in lifetime earnings, but Whiteout Survival keeps growing with over $370m earned to date.

Family Farm Seaside has been a steady performer for Century since launch in 2014 and has earned the developer ~$178m in that time, while Family Farm Adventure, launched in 2022, is close to overtaking the older title with ~$176m earned to date. Idle Mafia, meanwhile, has earned Century ~$73m to date.

The region split by revenue shows the US top with 31%, then China at 12% and South Korea with 10%. 56% of Century’s IAP revenue comes through the App Store, while the remainder, 44%, comes through Google Play.

Honor of Kings has 100m DAU

According to a LinkedIn post from Tencent label Level Infinite, Honor of Kings now has 100m daily players worldwide.

The milestone comes after its recent launch in Turkey, South Asia, North Africa, CIS and the Middle East. A full worldwide launch is coming later this year.

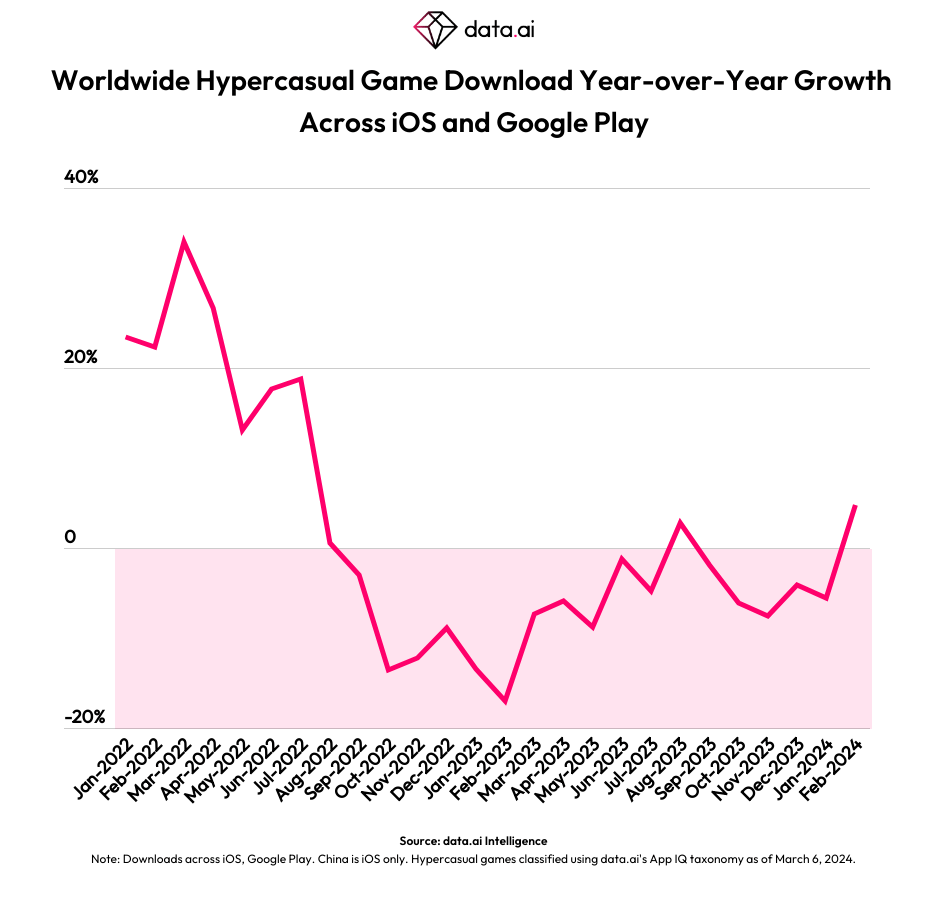

Is hypercasual recovering? data.ai says it might be

“The decline in hypercasual downloads appears to be slowing as we enter 2024,” says data.ai in its latest blog. “Year-over-year growth was positive in February 2024, just the second month of positive YoY growth we’ve seen for the genre since late 2022.”

The data firm also notes that while hypercasual game downloads declined 6.4% year-over-year in 2023, the dip was mostly for the leading titles; downloads for hypercasual games outside the top 1,000 increased slightly.

Nazara announces $100m M&A warchest

Indian games and sports giant Nazara plans to spend $100m on M&A in the next two years as part of an aggressive expansion plan. There will be a particular focus on cracking the US market, the company’s CEO and MD Nitish Mittersain (above) said.

The firm runs children’s apps Kiddopia and Animal Jam, Classic Rummy, the World Cricket Championship games and runs some esports teams and events.

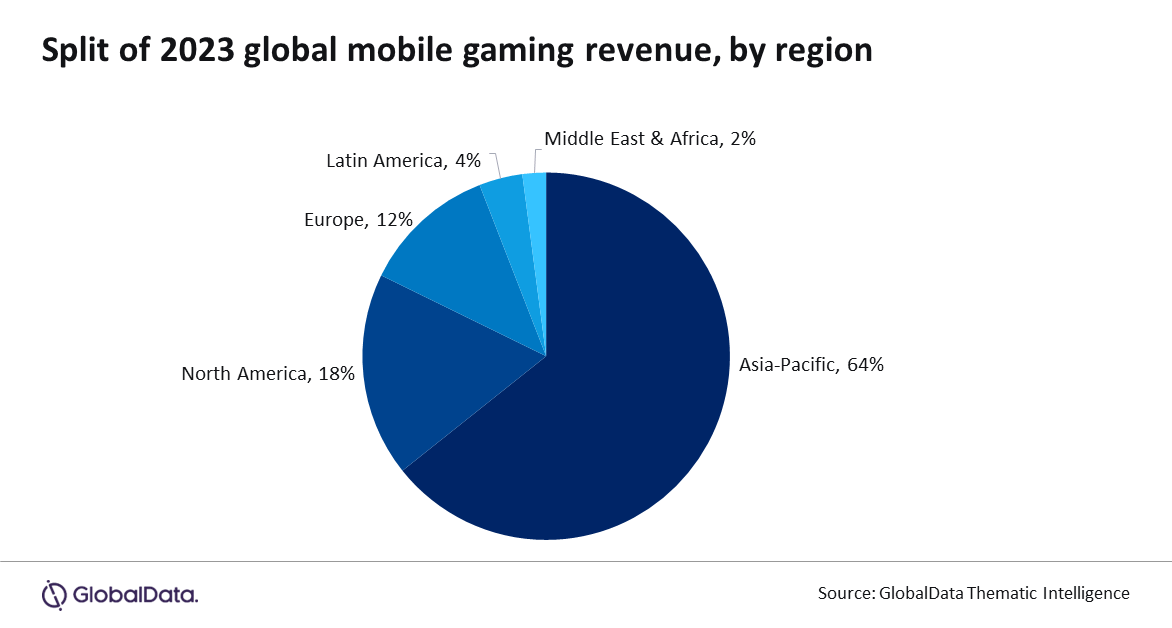

64% of spend comes from Asia-Pacific region

Analyst Global Data says that the Asia-Pacific region accounted for 64% of consumer spending on mobile games in 2023, reports gamesindustry.biz.

The total spend last year was $124bn, the firm said, with China on top with 31% of that total. The US accounted for 17% and Europe was third on 12%.

Global Data also noted that while China regulators pose a threat to growth overall, it expects mobile gaming revenue to hit $195bn in 2030.

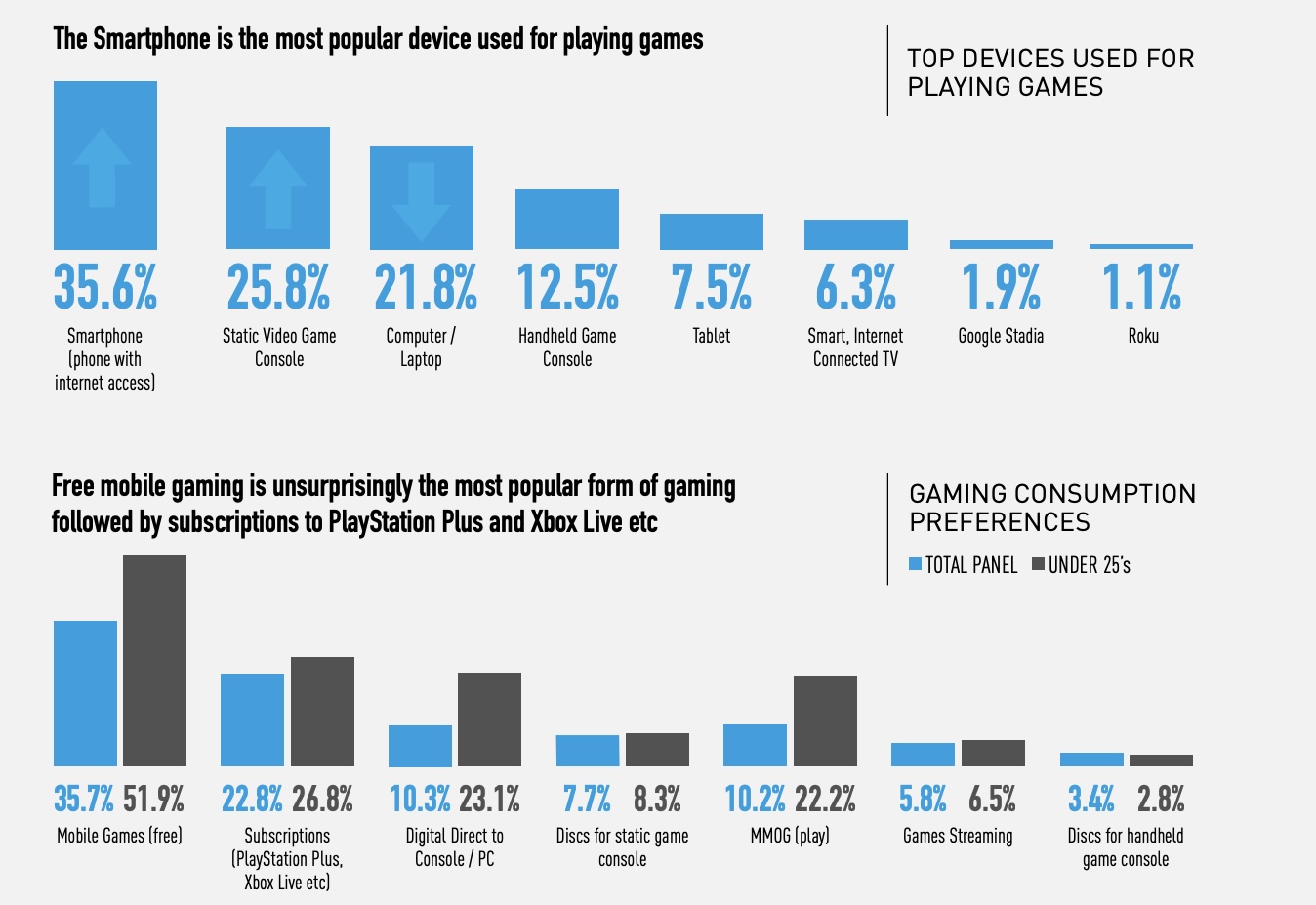

UK mobile game market down to £1.4bn in 2023

UK trade body ERA out put out a report last week stating that the UK mobile game market “experienced a rare annual decline in spend” last year, though it was a marginal drop, down 0.8% to just under £1.4bn for 2023.

The 2023 numbers above split out the mobile and tablet markets, but combined they accounted for 43.1% of play time. Mobile games are notably more popular with the under 25s, said ERA.